Table of Contents

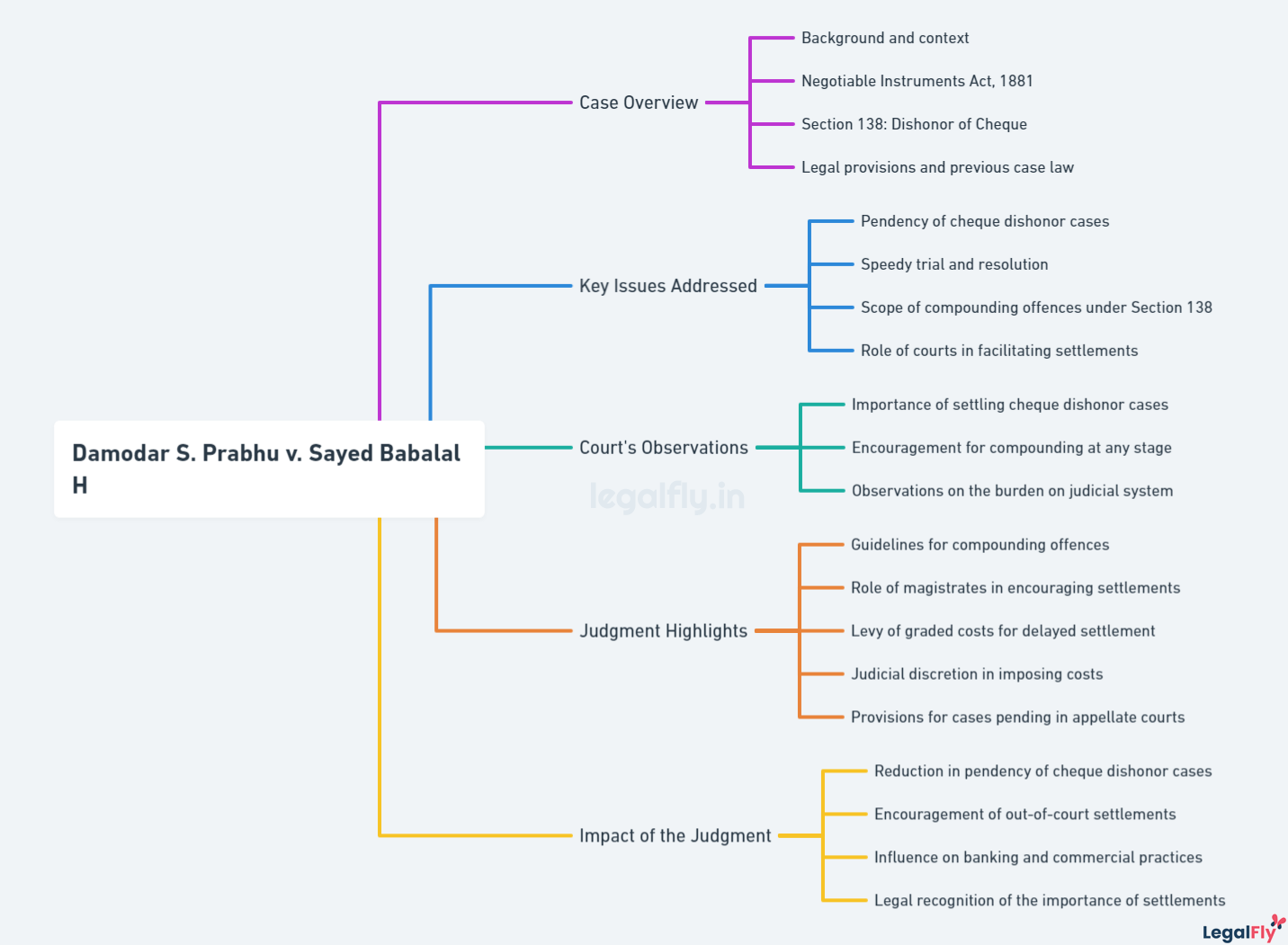

Case Name: Damodar S. Prabhu v. Sayed Babalal H

Court: Supreme Court of India

Year: 2010

Citation: (2010) 5 SCC 663

Introduction

The Damodar S. Prabhu v. Sayed Babalal H case is a landmark judgment in Indian legal history related to cheque dishonour cases under Section 138 of the Negotiable Instruments Act of 1881. Decided by a two-judge bench of the Supreme Court in 2010, this case laid down definitive guidelines regarding the compounding of cheque bounce offences that aimed to balance legal enforcement with judicial efficiency.

The dispute involved dishonour of post-dated cheques issued by Sayed Babalal H to Damodar S. Prabhu as part of the payment for the purchase of a flat. When the cheques bounced, Damodar filed a criminal complaint under Section 138. During the proceedings, Babalal requested compounding of the offence, but Damodar refused. The case eventually reached the Supreme Court, which delivered a nuanced judgment interpreting Section 138 while prescribing procedural guidelines for compounding in cheque dishonour cases.

This landmark ruling had far-reaching implications for cheque bounce disputes, banking operations, business transactions, and the broader criminal justice system. By prioritizing early compounding and settlement, the judgment introduced efficiencies in resolving cheque dishonour cases, which burdened Indian courts. The Damodar case and its guidelines are frequently cited in subsequent legal reforms and judgements on cheque bounce disputes.

Background and Context

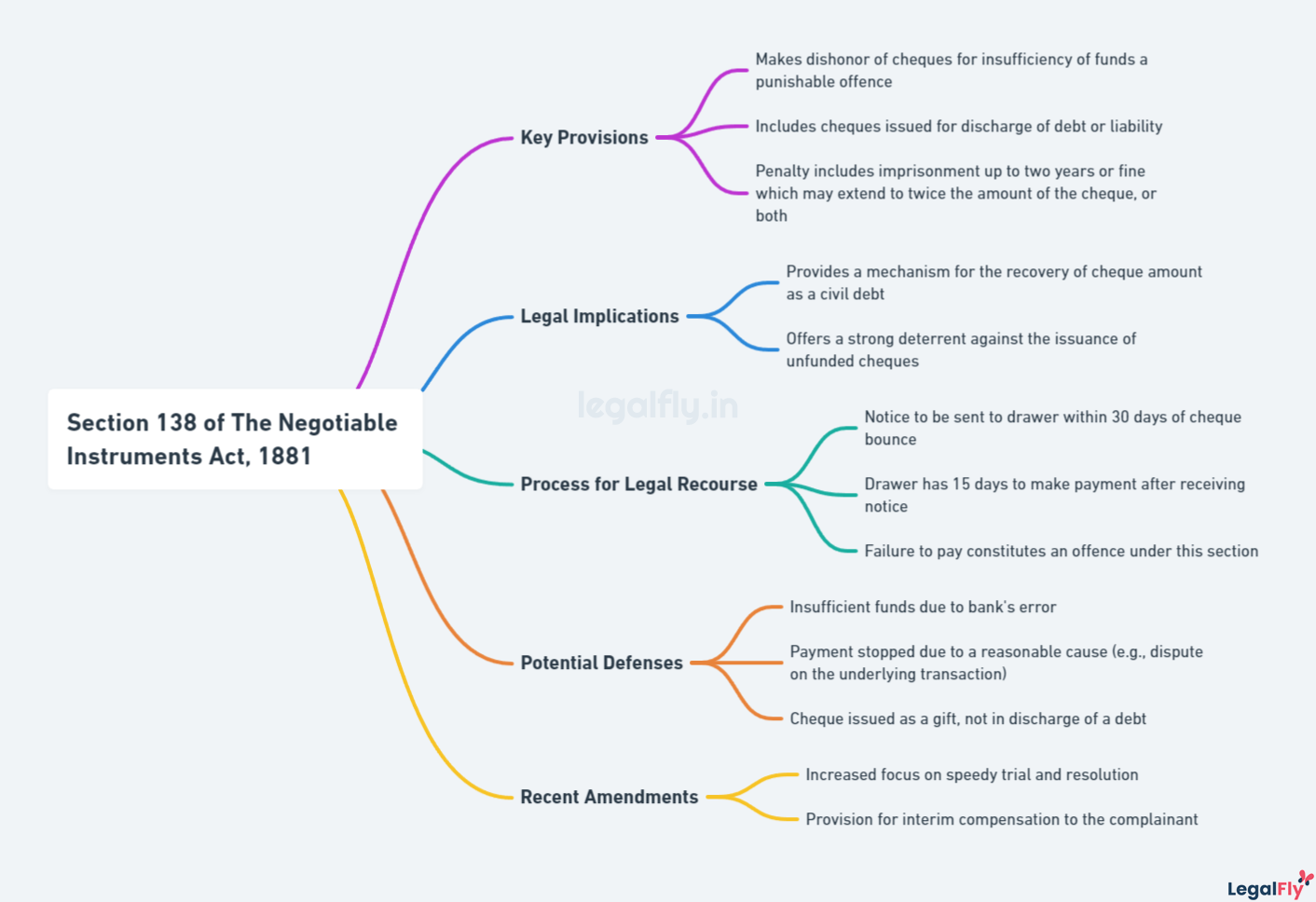

The Damodar S. Prabhu v. Sayed Babalal H case focused on interpreting Section 138 of the Negotiable Instruments Act, 1881, which deals with the dishonour of cheques. The Negotiable Instruments Act was enacted to define and amend the law relating to Promissory Notes, Bills of Exchange and Cheques. Section 138 was inserted in the Act in 1988 to enhance the acceptability of cheques in the settlement of liabilities and to provide credibility to negotiable instruments.

Section 138 creates criminal liability for cheque dishonour and provides a procedure to initiate the prosecution process. It imposes penalties and imprisonment of up to 2 years for the drawer of cheques that are dishonoured due to insufficient funds or if the amount exceeds the arrangement with the bank. The object is to ensure that obligations under negotiable instruments are discharged to increase the credibility of such instruments.

Facts of the Case

A dispute arose between Damodar S. Prabhu and Sayed Babalal H regarding the dishonour of cheques issued by Sayed Babalal H to Damodar S. Prabhu. Damodar S. Prabhu had sold a flat to Sayed Babalal H. As per their agreement, Sayed Babalal H had to make payments in instalments. He issued several post-dated cheques in favour of Damodar S. Prabhu for consideration for the flat’s sale.

However, five of the cheques issued by Sayed Babalal H in favour of Damodar S. Prabhu bounced due to insufficient funds when presented for collection. As a result, Damodar S. Prabhu filed a criminal complaint against Sayed Babalal H under Section 138 of the Negotiable Instruments Act, 1881, for the dishonour of cheques. This led to a legal dispute between the parties, ultimately reaching the Supreme Court of India.

The key details of the dispute were the dishonour of five cheques issued by Sayed Babalal H payable to Damodar S. Prabhu and the subsequent criminal complaint filed by Damodar S. Prabhu under Section 138 of the Negotiable Instruments Act. The Supreme Court examined the issues related to the compounding of offences under Section 138 in this case.

Legal Issues Addressed

The Supreme Court’s judgment in Damodar S. Prabhu v. Sayed Babalal H examined two key legal issues related to cheque bounce cases under Section 138 of the Negotiable Instruments Act:

Compounding of Offences in Cheque Bounce Cases

The first issue was regarding the compounding of offences under Section 138. The parties had reached a compromise and requested the Court to compound the offence under Section 147 of the Negotiable Instruments Act. However, the High Court rejected this request on technical grounds. The SC clarified the requirements for compounding and emphasized that courts should allow compounding in cheque bounce cases to reduce the pendency of cases.

Role of Section 147 of the Negotiable Instruments Act

The second issue concerned the scope of Section 147 and its interplay with Section 138 regarding the composition of offences. The SC explained that Section 147 provides a substantive right to the parties to compound a case under Section 138, even at the appellate stage. This was an important clarification on the process of compounding in cheque bounce cases.

Supreme Court’s Guidelines and Directions

In the Damodar S. Prabhu v. Sayed Babalal H case, the Supreme Court laid down several important guidelines regarding the compounding of offences under Section 138 of the Negotiable Instruments Act. The Court emphasized the need for early compounding of cheque bounce cases to reduce the burden on the judiciary.

Some key guidelines issued by the Supreme Court were:

- Courts cannot compel the complainant to consent to compound the offence; the payee’s consent is essential for compounding.

- The accused’s mere repayment of the cheque amount does not entitle him to acquittal or discharge. The complainant’s consent is still required.

- Compounding can be allowed only after repayment of the cheque amount, along with accrued interest and costs imposed by the Court.

- Compounding will not be permitted if the accused commits repeat offences of cheque bouncing.

- Courts should encourage compounding as soon as possible, given the impact delays have on the judiciary, banks, and trade.

- The guidelines aim to balance the rights of the complainant with judicial efficiency.

The guidelines streamlined the compounding process and clarified the role of the courts and parties involved. This prevented arbitrary compounding while reducing delays in cheque bounce cases.

Supreme Court’s Decision and Rationale

The Supreme Court delivered its judgment in the Damodar S. Prabhu v. Sayed Babalal H case on 3 May 2010. The Court held that offences under Section 138 of the Negotiable Instruments Act should be compounded at an early stage, and delays should be avoided. Some key points from the judgment are:

- The Court emphasized the need for expeditious disposal of cheque-bouncing cases relating to cheque dishonour. Delays in such cases affect the credibility of transactions.

- The accused should make an application for compounding under Section 147 immediately after receiving the summons from the Court. This allows for early disposal of the case through the process of compounding.

- If the accused does not apply for compounding soon after receiving the summons, the Court should direct them to file an application for compounding.

- The power to compound offences under Section 138 rests with the complainant. They can make a request to the Court to compound the offence at any point during the case proceedings.

The Supreme Court provided this rationale for its guidelines:

- The judgment aimed to balance the interests of the complainant and the accused. It wanted to uphold the credibility of transactions but also provide some leniency to the accused.

- Compounding the offence early on saves court time and speeds up the judicial process, improving efficiency in the legal system.

- The judgment sought to reduce the burden on the courts posed by a large number of cheque-bouncing cases. Compounding allows for swifter resolution.

- The Court recognized that the offence under Section 138 primarily involves a civil transaction, even though it is classified as criminal. The guidelines account for this.

- By expediting compounding, the judgment helped maintain confidence in business transactions and banking operations dependent on cheques.

Implications of the Judgment

The judgment in Damodar S. Prabhu v. Sayed Babalal H had significant implications for legal practices related to cheque dishonour cases under Section 138 of the Negotiable Instruments Act.

One of the most critical impacts was on the process of compounding offences in cheque bounce cases. The Supreme Court guidelines clarified that offences under Section 138 should be compounded at the earliest opportunity, preferably in the pre-trial stage itself. This enabled accused persons to avoid prolonged litigation if they were willing to make amends. The consent of the complainant was still required to compound the offence. However, if there was an unreasonable delay by the complainant, the accused could approach the High Court under Section 482 of the CrPC to quash proceedings.

The judgment also affected banks’ practices in dealing with dishonoured cheques. Banks had to be more careful in ensuring that cheques issued by customers had sufficient funds before presenting them. At the same time, they had to expedite the process of informing customers about cheque dishonour to enable early settlement.

For lawyers, the Damodar S. Prabhu v. Sayed Babalal H case highlighted the need to advise clients to compound Section 138 offences as soon as possible. It enabled them to settle cheque bounce cases quickly through mutual settlement rather than opting for prolonged litigation. Lawyers also had to pay greater attention to the technicalities of Section 138 and ensure strict compliance with notice periods.

Overall, the judgment brought more clarity and uniformity to legal practices related to negotiable instruments and cheque dishonour cases across the country. It paved the way for faster dispute resolution mechanisms that balanced the interests of complainants and accused persons. The case had a significant impact on improving efficiency in this area of banking and business law.

Conclusion

The Damodar S. Prabhu v. Sayed Babalal H case is a landmark judgement by the Supreme Court that established important guidelines regarding Section 138 of the Negotiable Instruments Act. The case has had far-reaching consequences for cheque bounce disputes and helped streamline legal procedures related to dishonoured cheques.

Summary of Key Takeaways

- The Supreme Court interpreted Section 147 to allow the compounding of cheque bounce offences by amicable settlement between parties without the Court’s permission. This enabled faster case disposal.

- The Court directed that compounding should be encouraged in the early stages of litigation to reduce delays. If both parties agree, offences can be compounded even after conviction.

- Clear guidelines were established to expedite trials, limit adjournments and avoid procedural delays. Courts were advised to complete proceedings within six months.

- The judgement upheld the credibility of cheques as a mode of payment and strengthened the legal provisions against cheque bouncing.

- By balancing the interests of the payee and drawer, the Court aimed to ensure justice as well as faster resolution of disputes.

- The Damodar case enabled the compounding process for cheque bounce cases to become more structured, transparent and streamlined.

- The precedent influenced the creation of Fast Track Courts and Tribunals to handle Negotiable Instruments Act cases.

- The judgement enabled fair and equitable enforcement of legal remedies against cheque dishonour.

Frequently Asked Questions

What was the outcome of the Damodar S. Prabhu v. Sayed Babalal H case?

The Supreme Court set aside the conviction of Damodar S. Prabhu under Section 138 of the Negotiable Instruments Act, 1881, in Damodar S. Prabhu v. Sayed Babalal H (2010) 5 SCC 663. The Court held that the offence under Section 138 was compoundable, and Section 147 allowed the parties to compound the offence at any stage, including after conviction. This paved the way for expediting the legal process in cheque dishonour cases.

How did the judgment affect compounding procedures?

The Damodar S. Prabhu judgment simplified the compounding process in cheque bounce cases under Section 138. It held that the offence can be compounded by the parties at any stage of litigation – before or after conviction – based on mutual consent. This reduced delays by allowing compounding even after the completion of the trial.

What are the implications for Section 138 cases?

The Damodar S. Prabhu case has made it easier for businesses to resolve cheque bounce disputes through compounding. The judgment recognized the rationale behind Section 147 and emphasized expedited compounding to unclog courts. It established binding guidelines to allow compounding at all stages, significantly impacting legal practices for Section 138 cases.