Table of Contents

Overview of Section 138

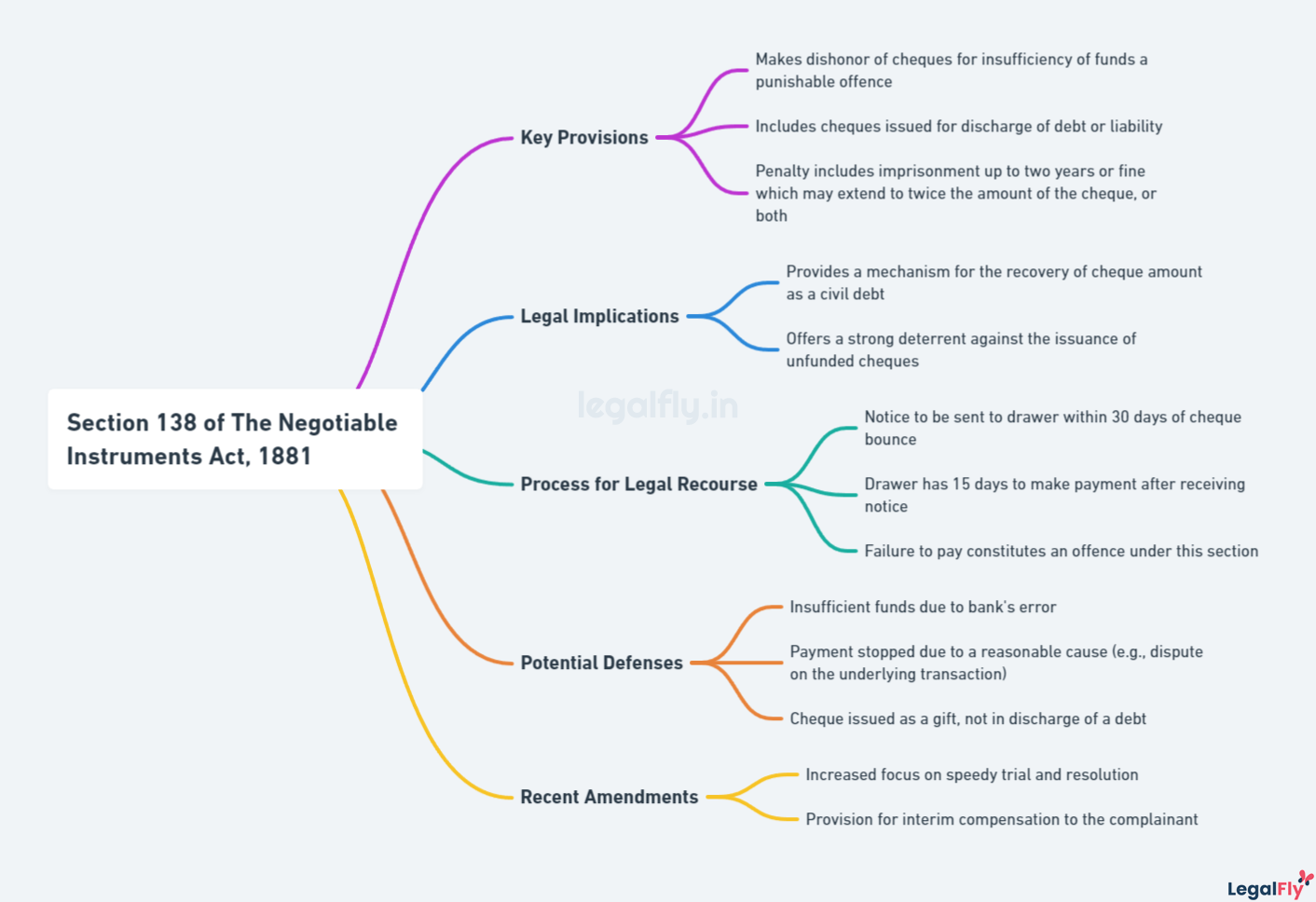

Section 138 of the Negotiable Instruments Act of 1881 deals with cheque dishonour due to insufficient funds in the account. This section was introduced via an amendment in 1988 to ensure the credibility of cheques and enable faster settlement of cheque dishonour cases.

Section 138 promotes cheque credibility, prevents cheque misuse, and ensures that legal consequences can be imposed for cheque default. This provides a civil remedy to cheque recipients and ensures they are not disadvantaged by dishonoured cheques.

Section 138 establishes penalties and procedures to deal with cases where cheques are dishonoured on the grounds of insufficient funds. It covers aspects like notice requirements, penalties, legal procedures, and liabilities. The scope includes all cheque transactions in India, providing a legal framework for cheque bounce disputes.

This section was introduced in light of increased business transactions involving cheques. Dishonoured cheques were causing financial loss and hardship. Section 138 provides a legal basis to impose fines and imprisonment, enhancing cheque credibility. It deters cheque misuse and protects payee rights. The background involves balancing the interests of drawers and payees for smooth business transactions.

Legal Framework of Section 138

Section 138 of The Negotiable Instruments Act of 1881 deals with cheque dishonour due to insufficiency of funds in the drawer’s account or if the amount exceeds the arranged overdraft. This section was inserted in the Negotiable Instruments Act in 1988 to enhance the acceptability of cheques and impart credibility to negotiable instruments.

The key provisions under Section 138 include:

- It applies to cheques dishonoured due to insufficient funds or if the amount exceeds the arranged overdraft. Dishonour, for other reasons, is not covered under this section.

- It covers only cheques, not other negotiable instruments like bills of exchange or promissory notes.

- The payee or holder should, in due course, make a written demand for payment within 30 days of receiving information from the bank regarding the dishonour of the cheque.

- If payment is not made within 15 days from receipt of notice, the drawer can be prosecuted under this section.

- Offences under Section 138 are cognizable and non-bailable.

The section defines key terms like ‘drawer’, ‘drawee’, ‘cheque’, ‘dishonour of cheque’, etc. It applies to both individual drawers and business organizations. The territorial jurisdiction is determined based on where the cheque is dishonoured by the bank on which it is drawn.

Provisions Under Section 138

Section 138 of the Negotiable Instruments Act lays down the criteria, conditions and penalties for a dishonoured cheque under this law.

Criteria for a Cheque Bounce Under Section 138

For an offence to be made out under Section 138 of the NI Act, the following conditions must be fulfilled:

- The cheque has been presented to the bank within six months from the date it is drawn or within its validity period, whichever is earlier.

- The payee or holder demands payment of the said amount of money by giving a notice in writing to the cheque drawer within 30 days of receiving information from the bank regarding the return of the cheque unpaid.

- The drawer fails to make payment to the payee or holder in due course within 15 days of the receipt of the notice.

Thus, Section 138 stipulates the prerequisites for constituting the offence of dishonour of cheques due to insufficiency of funds in the account.

Penalties and Legal Repercussions

If the criteria under Section 138 are met, the penalties and punishments are:

- Imprisonment for a term which may extend to two years

- Fine, which may extend to twice the amount of the cheque

- Both imprisonment and fine

The objective is to not only punish the offender but also provide compensation to the complainant. This aims to increase cheques’ credibility as a payment mode and ensure financial accountability.

Legal Procedures and Requirements

When a cheque bounces due to insufficient funds or any other reason, the payee or holder of the cheque has the right to initiate legal proceedings against the drawer under Section 138 of the Negotiable Instruments Act. This section lays down the procedures and requirements that need to be fulfilled for a valid legal case.

Notice Requirement for Dishonoured Cheques

According to Section 138, the payee or holder of the cheque should issue a written notice to the drawer within 30 days of receiving intimation from the bank regarding the dishonour of the cheque. This notice period allows the drawer an opportunity to make the payment to the payee within 15 days of receiving the notice. If the drawer fails to make the payment within this period, then a cause of action arises for the payee to initiate legal proceedings under Section 138.

Legal Process for Recovery and Penalties

If the drawer fails to pay within 15 days of the notice, the payee can initiate a criminal complaint under Section 138 before a Magistrate Court. The penalties for cheque bounce under Section 138 include imprisonment up to 2 years and/or a monetary fine up to twice the amount of the dishonoured cheque.

The Court will issue summons to the drawer, asking them to appear before the Court. If found guilty, the Court can impose a fine and/or imprisonment as per the provisions of Section 138. The complainant can recover the cheque amount through the process of civil execution in the same Court.

How to legally respond to a cheque bounce incident under Section 138?

If a notice is received under Section 138, the drawer should immediately make arrangements to pay the cheque amount to the complainant. If unable to make the payment, the drawer can submit a written reply to the notice raising any valid defense available under the law.

Some defenses include that the cheque was issued but subsequently stopped, that it was post-dated, that payment was made in cash, that it was issued under coercion, etc. The drawer must appear before the Court on the specified date and contest the case on the merits. Timely payment or reply can help avoid penal consequences under Section 138.

Impact and Importance of Section 138

Section 138 of the Negotiable Instruments Act is critical in protecting creditors’ rights and deterring financial misconduct in India. This provision establishes penalties for cheque bouncing, including imprisonment of up to two years and monetary fines. By imposing consequences for cheque dishonour, Section 138 aims to ensure creditors can recover what they are owed and that debtors do not default on payments without reason.

Protecting Creditor’s Rights

One of the main objectives of Section 138 is to protect the rights of the payee or creditor in cases where cheques issued to them bounce. The law provides creditors with a legal channel to recover their dues even if the cheque issuer defaults on payment. This prevents unscrupulous drawers from reneging on their financial commitments without facing penalties. Overall, Section 138 upholds cheques’ credibility as a payment mode and provides creditors recourse against loss.

Deterring Financial Misconduct

By criminalizing cheque bouncing, Section 138 also serves as a deterrent against financial malpractices. The law imposes punitive measures to disincentivize the deliberate issuing of cheques that are likely to bounce due to insufficient funds. This aims to curb fraudulent activities such as writing cheques simply to avail temporary credit. The penalties make drawers more cautious about issuing cheques without adequate balance. Thereby, Section 138 promotes financial discipline and honesty in commercial transactions.

Critical Analysis and Case Studies

Section 138 of the Negotiable Instruments Act has been the subject of many important court judgments that have shaped how the law is applied in practice. Some critical cases include:

- In Damodar S.Prabhu v. Sayed Babalal H, the Supreme Court held that the offence under Section 138 is primarily a civil wrong with criminal consequences. The Court outlined the procedures and requirements for a complainant seeking to initiate prosecution under this section.

- The Supreme Court judgement in Kusum Ingots & Alloys Ltd. vs Pennar Peterson Securities Ltd. examined the notice requirement under Section 138 in detail. It held that the notice must specifically state that payment should be made within 15 days, and a general notice is insufficient.

- In NEPC Micon Ltd. vs. Magma Leasing Ltd, the Supreme Court clarified that territorial jurisdiction for Section 138 cases is restricted to the Court within whose jurisdiction the offence was committed, which is where the bank dishonoured the cheque.

- The Constitution Bench judgement in M/S Meters and Instruments Private Limited vs. Kanchan Mehta outlined procedures to expedite trials for cheque bounce cases under Section 138.

These landmark judgements have significantly influenced business practices around cheque transactions. The strict notice requirement and territorial jurisdiction criteria have made businesses more cautious. Overall, the judgements uphold the objective of Section 138, which is to enhance the credibility of cheque transactions. However, businesses have also highlighted some concerns about the potential misuse of the provisions for harassment. The impact on businesses and commerce has been a key consideration in many Section 138 judgments.

Recent Amendments and Legal Debates

Several recent amendments have been proposed for Section 138 of the Negotiable Instruments Act, focused on decriminalizing minor cheque bounce offenses.

In 2018, the Law Commission of India recommended amendments to Section 138, proposing to decriminalize cheque bouncing when the amount does not exceed Rs 20,000. This aimed to reduce the burden on lower courts dealing with a high volume of cheque bouncing cases. However, the recommendations have not been implemented yet.

In 2020, the Supreme Court directed the central government to consider decriminalizing cheque bouncing offenses under Section 138 for cases involving small sums. It observed that imprisoning people for minor financial defaults seems excessive.

Currently, a 2021 amendment bill to decriminalize cheque bouncing is pending in Parliament. It proposes to remove imprisonment as a penalty for bouncing cheques up to Rs 2 crore and apply only financial penalties. This bill generated extensive debate on balancing business interests and creditor rights.

Proponents argue decriminalization will reduce frivolous litigation and ease court burdens. However, opponents contend it dilutes creditor rights and may encourage financial misconduct. The bill remains stalled amidst these ongoing legal discussions.

Section 138 is increasingly scrutinized to determine whether imprisonment is an excessive penalty for minor cheque defaults. However, views diverge on the right approach to balancing business needs and creditor interests. The legal landscape regarding cheque bounce penalties remains fluid, and more changes may be needed.

Conclusion

Section 138 of the Negotiable Instruments Act 1881 is a crucial legal provision that aims to enhance the credibility of cheques and ensure prompt remedy against defaulters in cheque bouncing cases. It was introduced to promote trade and commerce through the use of cheques as a reliable payment option.

The law provides a legal framework to impose penalties and initiate prosecution in cases of dishonoured cheques due to insufficient funds or other reasons. It stipulates a notice period, penalties, and procedures to deal with cheque bounce cases. The Supreme Court has upheld the constitutionality of Section 138 and emphasized that it does not violate Article 21.

Overall, Section 138 serves as an essential instrument to protect the payee’s interests, prevent financial fraud, and deter people from issuing cheques without adequate balances. It aims to ensure the credibility of cheques as a payment method. The law has significantly improved cheque clearance rates and helped businesses recover payments expeditiously when cheques bounce.

However, some concerns persist regarding misuse of the law at times for purposes of harassment. There are ongoing policy debates around decriminalizing minor cheque bounce cases to prevent abuse. Further legal reforms may be needed to balance protecting creditor rights and preventing harassment of debtors over small defaults. However, despite some limitations, Section 138 of the NI Act remains a crucial law for regulating cheque-based transactions in India.